The first full trading week of 2026 got off to a shocking start after the United States arrested Venezuelan President Nicolas Maduro over the weekend.

Investors are taking their time to assess the fallout, however, judging by the market action today in Asia and Europe, following a week of holiday-thinned activity.

TODAY'S MARKET MINUTE

* Venezuela's acting president Delcy Rodriguez offered on Sunday to collaborate with the United States on an agenda focused on "shared development," striking a conciliatory tone for the first time since U.S. forces captured the oil-rich nation's president, Nicolas Maduro.

* The United States could raise tariffs on India if New Delhi does not meet Washington's demand to curb purchases of Russian oil, President Donald Trump said on Sunday, escalating pressure on the South Asian country as trade talks remain inconclusive.

* Global stock markets, riding high on AI euphoria at the start of 2026 may be disregarding one of the biggest threats that could spoil the party: a surge in inflation driven partly by the tech investment boom.

* The U.S. military’s ouster of Maduro is set to swiftly reroute Venezuela’s oil exports back toward the United States – and away from China. That will give U.S. refiners an immediate boost, but President Trump’s plans to revive production in the Latin American country may be slower to materialize, writes ROI Energy Columnist Ron Bousso.

* This past year won’t soon be forgotten. In 2025, conventional thinking about economics and investor behavior was frequently challenged, as dramatic changes in technology, energy and geopolitics drove markets in often unexpected ways. The ROI team handpicked 10 charts that help explain what happened in 2025 and what it might mean for next year.

MADURO CAPTURE

Geopolitics front and center at start of a new year Maduro is due to appear in a U.S. court later on Monday after his weekend capture, with U.S. President Donald Trump leaving open the possibility of another incursion if the United States doesn't get its way with Venezuela's interim leader.

Trump said on Sunday he could order another strike if Venezuela does not cooperate with U.S. efforts to open up its oil industry and stop drug trafficking. He also threatened military action in Colombia and Mexico and said Cuba's communist government "looks like it's ready to fall" on its own.

On the surface, markets are taking a sort of not-much-to-see-here approach.

In an era where geopolitics has become a key feature rather than a surprise, investor reaction is likely to be limited unless global supply chains are severely disrupted, some note. Oil prices drifted lower on Monday, with Brent crude last down 0.7% at around $60.04 per barrel.

OIL PRICES

In a global market with plentiful oil supply, analysts said any further disruption to Venezuela's exports would have little immediate impact on prices. On Sunday, the OPEC+ group kept oil output unchanged after a quick meeting that avoided discussion of the political crises affecting several of the producer group's members.

And world stocks rallied, suggesting that investors are largely brushing off weekend developments.

U.S. stock futures were higher, Japan's blue-chip Nikkei soared around 3% to near record highs hit last year and in Europe, stocks touched a record high, helped by a 3% gain in defense names.

Still, in a sign that heightened geopolitical uncertainty continues to be a dominant underlying theme, safe-haven gold climbed and other precious metals surged - building on a stellar 2025.

Gold added over 2% to $4,429 per ounce, holding below last month's record highs.

IRAN

Some political analysts say markets should not underestimate the potential for regime change, highlighted by the developments in Venezuela, noting Iran — another energy-rich nation — is also worth paying attention to.

At least 16 people have been killed during a week of unrest in Iran, rights groups said on Sunday, as protests over soaring inflation spread across the country, kindling violent clashes between demonstrators and security forces.

Elsewhere, China's services activity expanded at its slowest pace in six months in December, as growth in new business softened and foreign demand declined, a private-sector survey showed on Monday.

The focus later this week will likely turn to Friday's U.S. December jobs report. Investors also await a U.S. Supreme Court decision on Trump's tariffs, along with his choice of a new Federal Reserve chair.

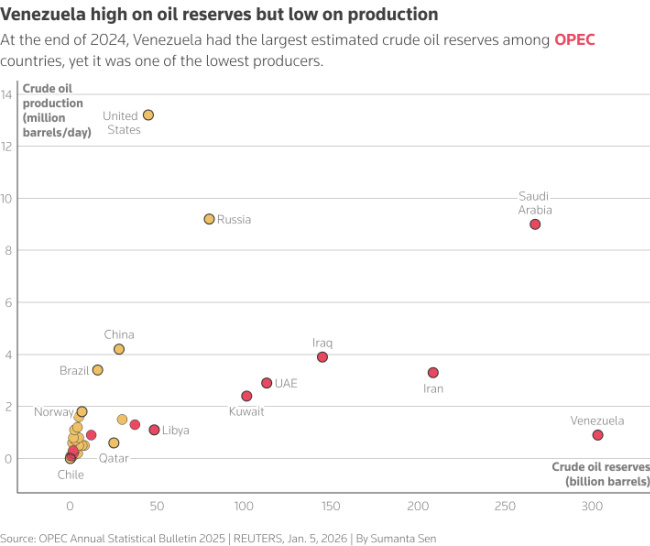

CHART OF THE DAY

.jpg.aspx;)

Venezuela has the world's largest estimated oil reserves, but its crude output is a fraction of its capacity due to decades of mismanagement, lack of investment and sanctions, official data shows.

JPMorgan estimates that with the right conditions, production could see a 250,000 barrel-per-day uplift from its 2025 average of 950,000 bpd in the short term, and rise to 1.3-1.4 million bpd within two years. Higher output is contingent on greater investment, it adds.

TODAY'S EVENTS TO WATCH

* ISM December manufacturing PMI

* U.S. Treasury Bill auction

© 2026 Thomson/Reuters. All rights reserved.