Buoyant world stock markets seem oblivious to the possibility that the U.S. government may be forced to shut down operations this week just as the third quarter comes to a close on Tuesday. But gold also raced to a new high above $3,800 an ounce as the dollar fell back once more.

With President Donald Trump due to meet top Democratic and Republican leaders in Congress on Monday to discuss extending government funding beyond month end, the most immediate impact of a shutdown could be to postpone the release of the critical September employment report that's due on Friday.

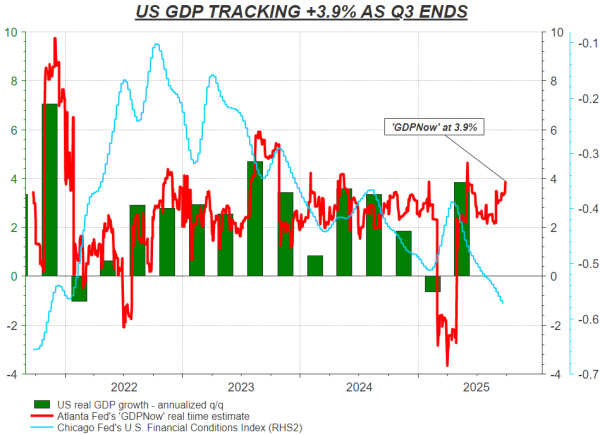

In the absence of a payrolls report, markets will have to feed off the rest of the week's labor market data — starting with August job openings tomorrow — and absorb the implications of last week's consumer spending rise that catapulted U.S. GDP growth trackers to as high as 3.9%.

That rate of growth and the loosest financial conditions in four years question the need for further rate cuts and a stream of Federal Reserve speakers are scheduled for Monday. U.S. stock futures are up again ahead of today's bell, with Japan underperforming overseas as the yen rose on speculation about an interest rate hike there.

SHUTDOWN JITTERS & FED OUTLOOK

Investors are bracing for a potential U.S. government shutdown starting Wednesday if Congress fails to pass a funding bill. A prolonged closure could delay key economic data, including Friday’s payrolls report, complicating the Fed's policy outlook ahead of its October meeting. Markets currently price in about 40 basis points of easing by year-end, with a 90% probability of an October cut.

QUARTER-END POSITIONING

U.S. stocks closed higher Friday after August PCE inflation matched expectations, though all three major indexes ended the week lower. The Dow gained 0.7%, the S&P 500 rose 0.6%, and the Nasdaq added 0.4%, as investors balanced resilient economic data with hopes for further Fed easing. Analysts expect Q4 to be seasonally strong, with the S&P 500 historically gaining in 74% of fourth quarters.

TARIFF SWEEP

President Trump announced new tariffs on heavy-duty trucks, branded pharmaceuticals, and home furnishings, sparking sharp moves in related shares.

Truck maker Paccar jumped 5.2% on expectations of domestic demand, while Eli Lilly gained 1.4%. The measures, which take effect Wednesday, add another layer of uncertainty for trade-sensitive sectors as markets head into Q4.

Trump is also considering imposing tariffs on foreign electronic devices based on the number of chips in each one, Reuters sources said.

TODAY'S MARKET MINUTE

Donald Trump will host Israeli Prime Minister Benjamin Netanyahu at the White House on Monday, with the U.S. president pushing a Gaza peace proposal after a slew of Western leaders embraced Palestinian statehood in defiance of American and Israeli opposition.

Moldova's pro-European ruling party won a resounding victory over its Russian-leaning rival in a key parliamentary election, results showed on Monday, a major boost for the country's bid to join the EU and break away from Moscow's orbit.

China's new visa program aimed at attracting foreign tech talent kicks off this week, a move seen boosting Beijing's fortunes in its geopolitical rivalry with Washington as a new U.S. visa policy prompts would-be applicants to scramble for alternatives.

Tech giants are plowing money into artificial intelligence. But, writes Panmure Liberum investment strategist Joachim Klement in his latest piece for ROI, rising long-term Treasury yields could jeopardize the investment boom in data centers and other infrastructure.

Ukraine's repeated strikes on Russian energy infrastructure have dealt a serious blow to Moscow's vital fuel exports just as Western sanctions are tightening. But if these attacks are too successful, writes ROI energy columnist Ron Bousso, they risk raising Trump's ire.

CHART OF THE DAY

Consumer spending, which accounts for more than two-thirds of economic activity, rose 0.6% last month — slightly faster than forecast but enough to push the Atlanta Fed's third-quarter GDP growth estimate to a 3.9% rate from a 3.3% pace earlier.

TODAY'S EVENTS TO WATCH

* U.S. August pending home sales (10:00 AM EDT); Dallas Fed manufacturing survey (10:30 AM EDT)

* Federal Reserve Board Governor Christopher Waller, New York Fed President John Williams, Cleveland Fed President Beth Hammack, Atlanta Fed boss Raphael Bostic and St. Louis Fed chief Alberto Musalem all speak; European Central Bank chief economist Philip Lane speaks; Bank of England Deputy Governor Dave Ramsden speaks

* U.S. corporate earnings: Carnival

* UK finance minister Rachel Reeves speaks at ruling Labour Party annual conference

* Canada's Prime Minister Mark Carney visits London

© 2026 Thomson/Reuters. All rights reserved.