Bernie Sanders in his debate with Ted Cruz on October 18 repeated the socialist offering to better provide for the weakest of our society — of course by taxing us all more. But let’s look technically at what Bernie’s offerings would really mean to us as citizens. The basic tenets of socialism are extremely seductive, “From each according to his ability, to each according to his need.” But how does “From each according to his ability…” get enforced? The government decides where, when, and how you work and, hand-in-hand with work, where, when and how each of us live. Personal decisions that most in the United States see as the core meaning of the “pursuit of happiness.”

.png.aspx?width=550&height=330)

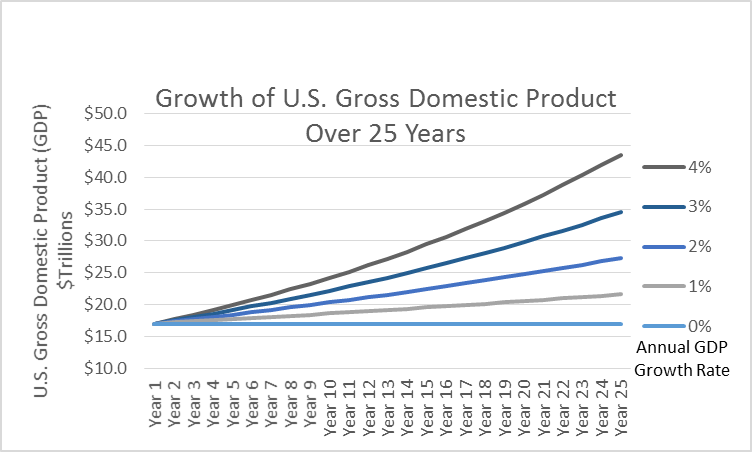

Figure 1. The size of the economy more than doubles in 25 years with 3% annual economic growth.

“Compound Interest is the most powerful force in the universe.” — Often attributed to Albert Einstein

But for today, let’s only look at the government revenue that will pay for the services Bernie touts. The government gets money directly by taxing our income, services, and property and indirectly through a complex structure of business taxes and “fees” on services. In the simplest sense we can model this as a “net tax rate” with the government taking a percentage of Gross Domestic Product (GDP) — the total production of all the people in the country. We’ll start with the 2017 U.S. GDP of $17 trillion and total federal revenue of $3.21T for a starting point of 19 percent tax rate. In this model, the government’s tax revenues increase by raising the tax rate percentage or through a rising GDP.

If we can get to an annual growth rate of 3 percent, we will deliver double the size of the U.S. economy to our children in 25 years. 1 percent more and we more than triple its size. The question is — how do we do this? Congress is now proposing to increase GDP by lowering the percentage of taxation. Will this work? To explore this, I will employ a concept taught in business school called “creating value” — a simple term meaning that a business delivers a product or service at an amount above what it costs to make or deliver the product. To the customer, value is a complex combination of many factors including cost, performance, and vague things like community relations. To a business, this extra amount is the profit margin that the business creates in dollars. To make it simple, though, if a business doesn’t create value for its customers it is driven out of business by competitors that do. Creating value is the fuel of competition in a free enterprise economy and is the incentive to continuously improve.

So let’s look at what happens with a tax rate reduction to less than the current 19 percent. How these funds left in the hands of business owners and individual taxpayers are reinvested in the economy will be the subject of a follow on article. For now, though, let’s assume that personal and business incentives in a free enterprise economy turn this 1 percent tax reduction into 1 percent per year GDP growth.

Figure 2 shows what that growth means in federal government tax revenue. We can see that tax reduction below 19 percent returns tax revenues exceeding an “economy killing” tax rate in 6 years and then rapidly grows to deliver far larger total tax revenues — by reducing the tax load not by increasing it! A modest reduction in federal taxes today provides far more funds available to meet the expected future budget shortfalls of growing “entitlements.” In addition, the GDP growth with the underlying continuous improvement brings better, more competitive products to each of us while providing the additional societal benefits generated by continuous re-investment in better production facilities, infrastructure, and processes.

Figure 2. A growing Gross Domestic Product stimulated by lower taxes quickly restores near term lost revenue and provides huge growth in federal tax revenues after 6 years.

And getting back to Bernie — the 21 percent line in Figure 2 labeled as “economy killing” represents an increased tax rate that might fill some of Bernie’s dreams of socialism with a near term increase in tax revenues of $400M. But with these increased taxes we get stagnant economic growth. Will we be satisfied with these same tax revenues 25 years from now when we could have more than double that amount? Will this meet social security commitments 25 years in the future? How do we balance a budget with ever expanding “entitlements”?

This lack of GDP growth and the concomitant lack of tax revenue growth is exactly what has happened in every experiment in socialism over the last 100 years. A government that attempts to provide the instant gratification today that Bernie calls for, results in a stagnant economy that, in the long run, fills no one’s expectations. Compare this to continuous capital reinvestment in buildings, infrastructure and tools, continuous improvement in products, and the ever increasing tax base with a rising GDP. Together these factors improve quality of life for all while dramatically increasing our ability to support the needs of the weakest in our society — and, even more important, without surrendering our culture of freedom and opportunity that Socialism would take away.

David Bryant had a first career as a U.S. Navy fighter pilot, test pilot, and aircraft carrier commanding officer followed by extensive experience in both large and small production companies. He has graduate degrees or equivalents in physics, aeronautical engineering, international relations, and nuclear engineering rounded out with an Executive MBA from the University of Washington. He is board member of the Theodore Roosevelt Association and active in politics in the other Washington. He strongly believes in Theodore Roosevelt’s oft quoted approach to foreign policy, “Speak softly and carry a big stick.” To read more of his reports — Click Here Now.

© 2026 Newsmax. All rights reserved.