The S&P 500 continues to hit new highs, buoyed by strong earnings and relentless enthusiasm for technology and artificial intelligence. Yet beneath the surface, valuations are flashing warning signs, Bloomberg reports.

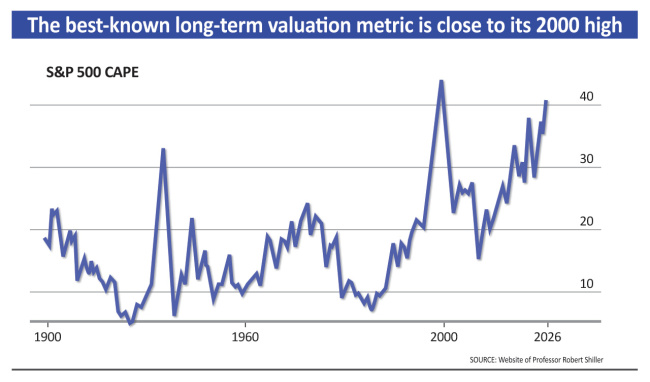

The best-known gauge of long-term market value, the cyclically adjusted price-to-earnings ratio (CAPE) popularized by economist Robert Shiller, has climbed above 40 — a level last reached during the dot-com bubble in 2000. Over the previous century, it had never approached that mark, not even before the 1929 crash.

While corporate profits and margins have expanded in recent years, even models that assume those record margins will persist show the market remains expensive.

Vanguard’s “fair value” analysis of the CAPE — which adjusts for profitability — suggests U.S. stocks are trading far above what long-term fundamentals justify.

“Valuations act like gravity,” said Qian Wang, Vanguard’s global head of capital market research, warning that U.S. equities are likely to lag non-U.S. markets over the next decade as returns revert toward historical norms.

This overvaluation extends well beyond the “Magnificent Seven” mega-cap tech names. The premium that U.S. stocks command over global peers has steadily widened since the financial crisis, reflecting both investor optimism and structural differences such as higher profit margins. Still, history shows that such extremes rarely persist indefinitely.

Urgent: Trump’s Warning, You’d Better Be Prepared for What’s Coming... See Here

Long-term data back that view. Deutsche Bank research comparing stock returns across countries over more than a century shows that markets with the highest valuations tend to deliver the weakest subsequent returns. In contrast, investors who buy when valuations are low — as in Japan today — tend to outperform.

Even if AI innovation and productivity gains justify some optimism, valuations this high limit future upside. High prices simply leave less room for disappointment.

In short, the market’s strength reflects confidence in U.S. corporate earnings — but the math suggests expectations may already be priced in. For investors with a long horizon, starting price still matters most, and by that measure, U.S. equities now look stretched.

© 2026 Newsmax Finance. All rights reserved.