For decades, Florida was a place where retirement was within reach for almost anyone willing to trade snow for sunshine.

That bargain is now breaking down, The Wall Street Journal reports.

“The retiree market is definitely shifting in Florida,” said Laura Cole, a senior vice president at Lakewood Ranch, one of the state’s largest master-planned communities. “The focus has moved from the value buyer to midmarket and high end.”

In 2023, Michele Butler, 70, and Wells Chapin, 82, moved from Michigan to Florida’s west coast as Butler prepared to step away from the restaurant business and ease into retirement.

The couple bought a $950,000 home in Lakewood Ranch, near Sarasota, a resort-style development designed to appeal to affluent retirees. Their days include golf, bike rides along winding trails, and evenings watching the sun set from their lanai.

A year later, Jim and Nina Cope, both in their mid-80s, were heading in the opposite direction.

The Copes sold their mobile home in a retirement community in Avon Park for $59,000 after repeated increases in lot rent made staying financially untenable.

They relocated to Haleyville, Alabama, where they purchased a $40,000 house and found their Social Security income and Navy retirement benefits went much further.

Those contrasting moves reflect a broader trend reshaping Florida’s retirement landscape.

Census data show that Florida is increasingly gaining older residents with higher incomes while losing those with more modest means.

According to a Wall Street Journal analysis of census data archived at IPUMS, net migration into Florida since 2013 rose 5% among households headed by someone 65 or older earning at least $125,000 in inflation-adjusted income. Over the same period, net migration fell 44% for households earning $75,000 or less.

The pattern is similar among those nearing retirement age. For households headed by someone 55 to 64, net migration grew 42% for higher-income earners while declining 17% for lower-income households.

Housing costs are a central factor behind the divide.

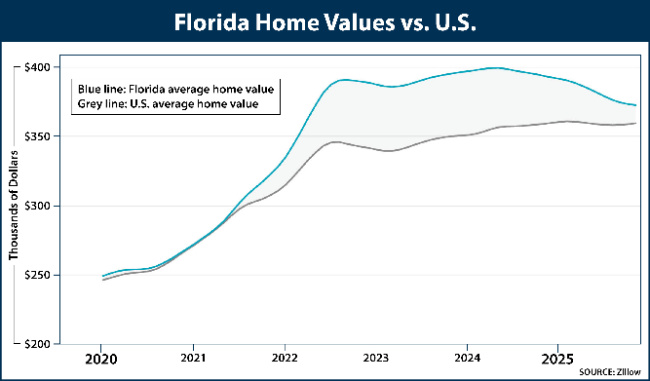

Florida’s average home value reached $372,000 in November, according to Zillow — down from recent highs but still far above the $246,000 average in 2019.

In retirement hubs, rising prices are compounded by higher insurance premiums, property taxes, and costs linked to stricter condo-safety rules enacted after the 2021 Surfside collapse.

Those pressures eventually pushed Michael and Linda Blanc to leave.

The couple, a 66-year-old retired funeral director and a 64-year-old retired nurse, had settled in Naples after moving from New York during their working years.

But rising expenses became difficult to absorb on a fixed income. Their home-insurance bill was set to jump from $1,000 to $4,800 a year unless they replaced their roof.

In 2025, the Blancs sold their Florida townhome for $350,000 and moved to Greenville, South Carolina, where they bought a house on a half-acre for $320,000.

They say their ongoing costs — including insurance and property taxes — are now significantly lower.

Florida is still attracting retirees in large numbers.

Increasingly, though, those who can stay are those who can afford homes like Butler and Chapin’s — not those living on Social Security checks, fixed pensions, or modest savings.

The state once promised a comfortable retirement for the middle class.

Now, it is increasingly offering a luxury version instead.

© 2026 Newsmax Finance. All rights reserved.