The Federal Reserve’s decision to cut interest rates came as no surprise. We at Elliott Wave International have tracked the Federal Reserve’s interest rates decisions for years. (See our articles here, here and here). The Fed doesn’t set interest rates. Investor psychology controls the movement of rates, and the Fed follows.

Our longstanding model, which is grounded in this socionomic precept, simply applies the yield on short term U.S. Treasury securities to predict what the U.S. Federal Reserve will do with respect to the federal funds rate. As The Socionomic Theory of Finance explains, “History shows that the T-bill market moves first, and the Fed’s interest-rate changes follow.”

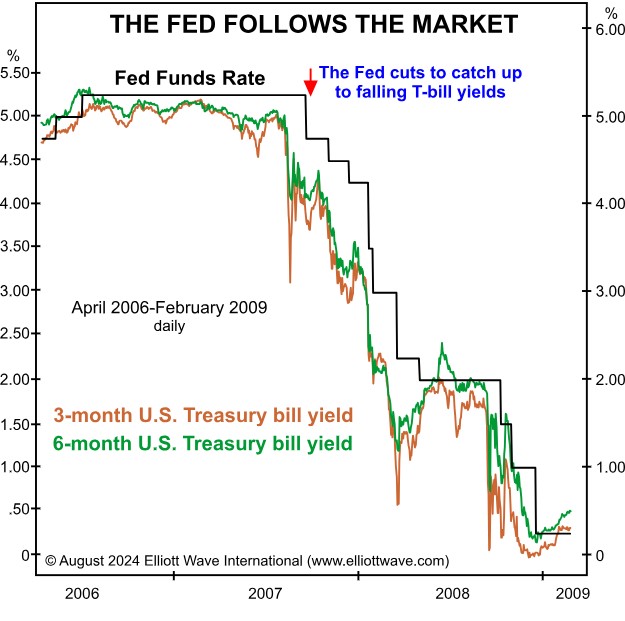

We showed a real-time example in September 2007 when we predicted the Fed was about to lower its fed funds rate dramatically. The chart below is a version of the chart we published back then. Observe how short term T-bill yields were dropping markedly below the then-current fed funds.

The market was signaling impending economic contraction and pressing the Fed to lower the fed funds rate. The longer the Fed waited, the more extreme their cut had to be to align the fed funds rate with freely traded market rates.

The Fed finally caved on September 18, 2007, dropping the fed funds rate 0.5%, from 5.25% to 4.75%. It was the first in a series of fed-fund cuts that eventually led to a rate of 0.25%, essentially zero, by December 2008, when the U.S. economy was mired in the “Great Recession,” which continued through the middle of 2009. The Fed, as always, was late. It was lagging the decline in the 3- and 6-month T-bill yields the entire way down.

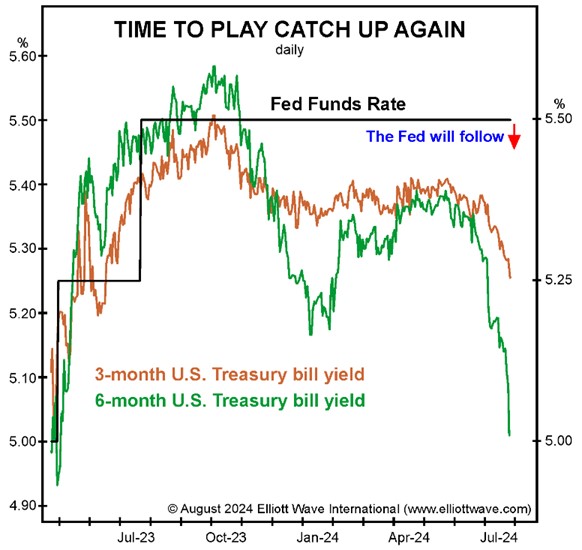

The Fed’s decision to cut the fed funds rate by an “extra-large half-percentage point” (Axios) on September 18 is another example of the Fed simply following the market.

In the August Elliott Wave Financial Forecast, we noted that the yield on both 3-month and 6-month Treasury bills had dropped well below the fed funds rate. We showed the chart below and said, “The pressure is mounting on the Fed to lower the fed funds rate to align with T-bill rates, which again are signaling impending economic weakness. The more the Fed waits, the more dramatic their reduction will be as they play catch-up to the market.”

And that’s exactly what happened.

Pay no attention to that man behind the curtain.

The idea that the Fed is the commander of the economy and the markets is a myth. See chapters 1 and 2 of The Socionomic Theory of Finance for more on this misconception and other widespread investor myths.

________________

Steven Hochberg co-edits Elliott Wave International’s Elliott Wave Financial Forecast with Peter Kendall, writes the Short Term Update thrice weekly, and provides commentary on the U.S. stock market, interest rates and precious metals for Global Market Perspective.

© 2026 Newsmax Finance. All rights reserved.