Many community banks, the traditional “financial lifeline” for numerous towns and neighborhoods are in trouble according to veteran Gada Elkenani, of banking-consulting firm Xeper Strategic Partners. Her fund: Building Better Banks and white paper: “Empowering Community Banks,” focus on investing in community banks while enhancing their sustainability and growth.

Xeper’s platform has been designed to support banking executives navigating today's market environment, increase shareholder value and build consumer confidence.

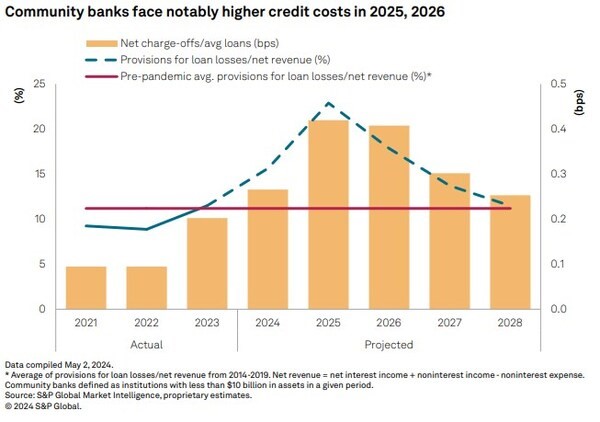

Other industry watchers like S&P Global Market Intelligence have noted that margin pressure and higher credit costs are expected to reduce community bank earnings by 12 percent year-over-year before rebounding in 2025 and 2026, according to S&P’s 2024 U.S. Community Bank Market Report.

Elkenani says the near-term outlook for community banks may actually be worse. “Signs of distress are appearing. Layoffs and expense-cutting are happening. Hopefully there will not be much balance-sheet hemorrhaging.”

Elkenani, who’s had firsthand experience with distressed banks, notes three key areas that need to be addressed for a successful turnaround -- financial literacy, non-profit relationships and human-capital development.

“We’re witnessing a potential food-chain dynamic. The number of community banks may shrink by 20%,” says Elkenani. “Subsequently, super-regionals and nationals will enter more local markets.”

A survey taken earlier this year by liquidity-management firm IntraFi found that 42% of bankers cited margin compression as the biggest challenge, while 34% cited deposit competition. “Many banks feel like they have a good handle on their own loan book,” said Mark Jacobsen, IntraFi CEO. “But there are broader concerns about credit quality related to commercial real estate.”

Rate cuts would offer modest relief in community banks' funding costs but more substantial cuts will be needed to drive deposits costs notably lower according to the S&P report. Should interest rates decline, U.S. community bank earnings may strongly rebound in 2025 as net interest margins rebound and rise again in 2026 as provisions for loan losses decline.

Known for their in-depth local knowledge, many have proven to be indispensable for the success of small businesses, area non-profits and other entities that might face cynicism from the much larger national and super-regional banks.

Seventy percent of CROs surveyed late last year by the Risk Management Association (RMA) anticipate a deterioration in both consumer and commercial credit quality over 2024. While the macroeconomic outlook appears to be “less dire” than a year ago, more than half of CROs still believe the environment will worsen.

In June the Community Development Bankers Association (CDBA) and National Bankers Association (NBA) launched the Advancing Communities Together (ACT) Deposit Program. Designed to provide direct funding to banks serving low-income and minority communities while ensuring all deposits are eligible for FDIC insurance, initial contributors included Blackstone, BNY Mellon, Warburg Pincus, and IntraFi.

Martin Brand, Head of North America Private Equity at Blackstone, said via a news release: "Community banks play an essential role in boosting economic growth and job creation across the country. We're pleased to support this innovative partnership to help expand access to capital in underserved markets throughout the US."

“Our local merchants and neighborhoods need community banks,” said Elkenani. “And community banks need a long-term, survival strategy.”

_______________

Jeffrey Dumas has more than 30 years of experience as a public relations professional specializing in financial services.

© 2026 Newsmax Finance. All rights reserved.