This tweet made my day:.jpg.aspx;)

If you don’t get it, you probably missed the biggest lumber boom in history. Since the beginning of COVID, lumber prices have shot up five times. This year alone, lumber doubled, reaching an all-time record of $1,670 per thousand feet of board.

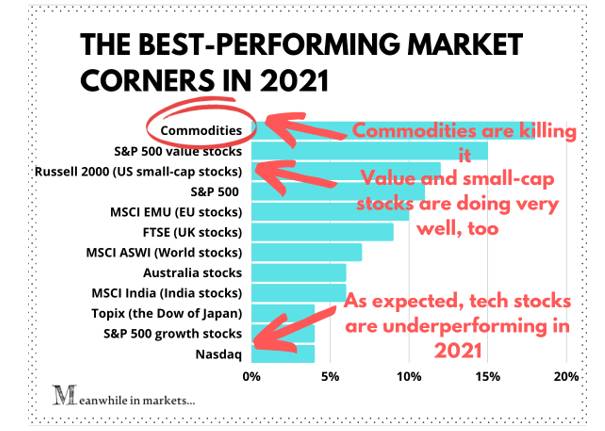

Jokes aside, this boom is not about lumber. The prices of all raw materials, from copper to soybeans, are marching higher. And so far, commodities are the best performing market corner this year:

.jpg.aspx;)

So today I’m going to talk about commodities. I’ll discuss what’s driving their prices right now, the bear and bull case that could shape this market, and how you can invest in it.

But first, what commodities are and the role they play in the economy.

Why commodities became so expensive all of a sudden

In human terms, a commodity is any raw material — from industrial metals like copper and steel to livestock — that you can trade on an exchange. (Yes, you can trade pigs if you’re in the mood.)

These basic goods are the first thing that goes into the production of a finished product, which means they are highly cyclical. In other words, the better the economy is doing, the more stuff it’s making. The more stuff it’s making, the more raw materials it needs. And vice versa.

So why are commodities soaring so much when the economy has barely recovered? Have people begun building five times more homes? Or have vegans given in to the inescapable allure of bacon (lean hogs are up 68% this year)?

Not so. At this point, surging commodity prices are less a demand problem and more a supply problem.

You see, COVID caused all sorts of disruptions for material producers. Even worse, COVID messed up planning.

Take lumber producers for example. Who would have thought that COVID would bring a housing boom? Imagine the lunacy of coming on CNBC with that thesis in March of 2020. So naturally, many lumber producers shut their operations, sold off inventories, and waited for better times.

Now, it’s not just materials producers that slimmed down. As recently as last December, inventories of American companies (relative to GDP) dried up to the lowest levels since 1992.

Until the last minute, businesses were playing it safe. But then vaccines came along, the recovery came within reach, and everyone went on a buying spree.

Now companies don’t just need to make more stuff. They also have to restock their drawn-down inventories. The entire supply chain is playing catch up. And that chain begins with raw materials.

Meanwhile, material producers can’t flip the switch back to On and start making stuff. There’s a lead time to bring back and extend operations.

The result: the world is suddenly short on everything. Materials are being gobbled up like AirPods on Black Friday. And prices are going up.

So the question is, is this commodity boom temporary? Is it, as I’ll show in a moment, a repeat of post-Great Recession boom and bust? Or, will it stick around?

Bears say this is just a repeat of the 2008 boom and bust

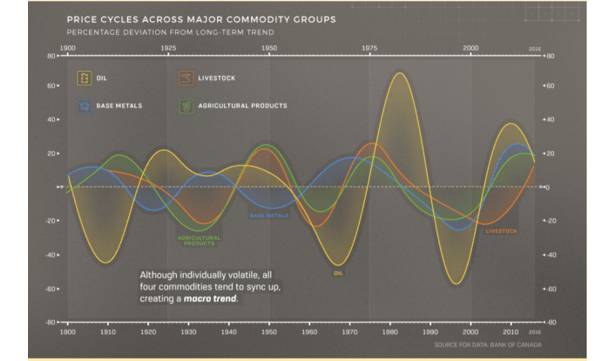

While COVID led to all sorts of weird disruptions, the bust and boom in commodities that came with it is not uncommon. Commodities have gone through similar cycles many times in history. And they offer an almost déjà vue-like view into today’s boom.

Take the Great Recession.

After the housing collapse, the global economy plunged into one of the worst recessions in history. Businesses went bust or scaled back. Demand for commodities dipped, producers flooded the world with raw materials, and the glut crashed their prices 50%.

But then fears blew over, businesses picked themselves back up and started producing more stuff. Commodity producers couldn’t meet the demand on such short notice. Materials became scarce. And by 2011, commodity prices went through the roof.

Meanwhile, high prices incentivized investments into the expansion of production and the supply gap was soon filled, crashing commodity prices ~50%.

So the bearish argument is that the “invisible hand” will fix this imbalance. After material producers work out supply bottlenecks, commodity prices will return to normal. If that’s not enough to meet demand, higher prices will encourage more investment into operations — which sooner or later will fill the gap.

Bulls say we are at the dawn of a new supercycle driven by green energy

The bearish case is all about commodities’ sensitivity to economic cycles, and how well they do when the economy recovers and supply lags, and then go bust when supply catches up.

But once in a while, commodities enter so-called “supercycles.” In a human language, this is when the world needs way more materials than expected for way longer than expected.

These supercycles span decades and their inertia keep pushing commodity prices higher for years, as you can see here:

.jpg.aspx;)

The last supercycle began in the late 1990s.

At the turn of the century, major emerging countries like China and India began rapid industrialization of their economies. These projects needed unthinkable amounts of energy and industrial materials like steel and copper.

As usual, supply lagged and commodity prices went up. By 2011, commodities peaked at four times higher prices before crashing. And to this day, they haven’t recovered to those levels.

The reason Goldman Sachs and JPMorgan are banging the drum on a new decade-long supercycle is multi-trillion-dollar investments that are coming into green energy.

In other words, the world is transitioning from a fossil fuel economy to a green energy economy. And that shift will require tons of materials from steel to lithium (by the way, since our discussion last December, lithium is up five times.)

For example, all electric equipment needs the best-non precious metal conductor — copper. Solar panels need lots of copper. EVs need lots of copper (in fact, 10 times more than the “dirty” cars). Everything.

Some analysts at Goldman Sachs go as far as calling copper the new oil.

The buildout of the green infrastructure will also require lumber, steel, and other industrial materials. Which could keep demand and prices for materials higher for years.

Stay ahead of market trends with Wall Street-grade insights

Every week, I put out a story that explains what’s driving the markets. Subscribe here to get my analysis and stock picks in your inbox.