As global auto sales slow after a decade of growth, carmakers are girding for a deeper downturn by slashing payrolls.

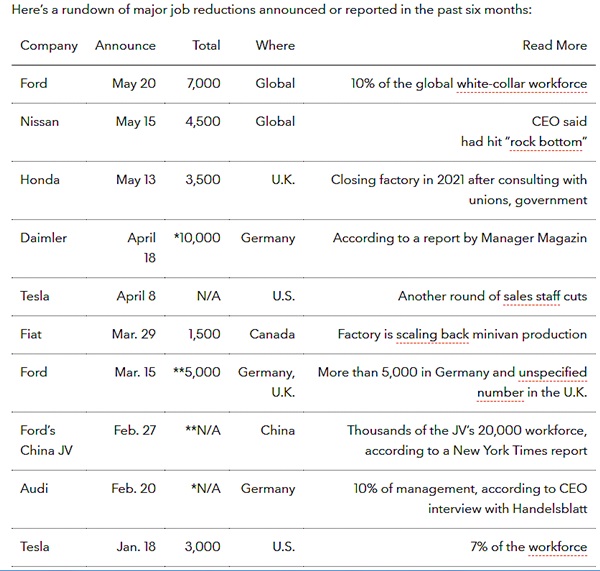

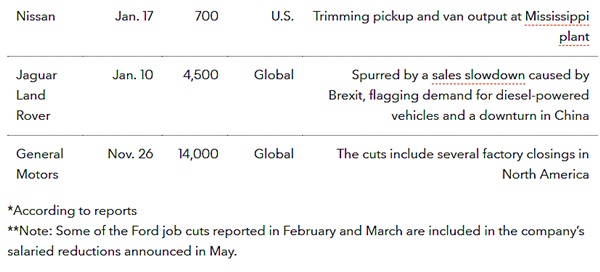

From China to the U.K., Germany, Canada and the U.S., companies have announced at least 38,000 job cuts in the past six months.

It may be just a beginning: Daimler AG’s departing chief executive, Dieter Zetsche, on Wednesday warned sweeping cost reductions are ahead to prepare for unprecedented industry upheaval. “Everything is under scrutiny,” the longtime CEO said as a farewell at an annual meeting in Berlin.

“The industry is right now staring down the barrel of what we think is going to be a significant downturn,” Bank of America Merrill Lynch analyst John Murphy said at a forum in Detroit on Tuesday, adding that the pace of decline in China “is a real surprise.”

Carmakers are cutting shifts or closing factories altogether across the globe, but the culling goes beyond that. Several recent rounds also target salaried workers, reflecting sluggish sales in the world’s two largest auto markets -- China and the U.S. -- and the pivot auto companies are making toward a future of electric and self-driving vehicles. Ford Motor Co. said Monday it will eliminate 7,000 jobs, or 10% of its white-collar workforce worldwide.

Global light vehicle sales fell 0.5% in 2018 to 94.8 million, which LMC Automotive said marked the first annual drop in global sales since 2009. Morgan Stanley projected in January another 0.3% drop this year, but a faster-than-expected deceleration in the Chinese market may have a more negative impact on sales.

“Auto companies globally are contemplating life where global production has greater downside risk than upside,” Morgan Stanley analyst Adam Jonas wrote in a report Tuesday. He said the chopping may not be over for Ford, estimating a 5% decline in revenue will require another 23,000 reduction in salaried jobs, assuming no other costs are pared back.

© Copyright 2026 Bloomberg News. All rights reserved.