If you were to do nothing but listen to President Biden and the corporate media

prattle on about the economy, you might think things sound great!

You would hear endless claims of “record economic growth” and quarter after quarter of “historic GDP.”

But that’s the main problem with Bidenomics in the media, it looks better on the surface than it’s actually performing under the hood.

When it comes to Biden’s recent gross domestic product and how well it’s actually performing, we’ll turn to a recent article written by Jim Rickards:

The point is that GDP growth is not being powered by economic fundamentals. It’s being powered by deficit spending. And the debt is growing faster than the economy itself. That’s unsustainable on its face...

At debt-to-GDP ratios below 90%, it is possible to get more than one dollar of growth for one dollar of new debt assuming the spending is done on growth-oriented projects including infrastructure. Once the debt-to-GDP ratio goes above 90%, the so-called “multiplier” drops below $1.00. This means that debt grows faster than the economy and the debt-to-GDP ratio gets worse. You can’t borrow your way out of a debt trap, but it seems that’s what the U.S. is trying to do.

In case you haven’t already guessed, the official debt-to-GDP ratio is well over 90% right now, and hasn’t dropped below 90% since the last major financial crisis back in 2008.

Which leads us to an important question: Is the Administration actually fueling an economic plane crash? By the looks of it, it would seem so.

Debt can lead to growth; excessive debt leads somewhere else

If you're racking up credit card debt to “grow” your personal economy, it won’t take long before you realize that isn’t a good idea.

Of course, the economy doesn’t operate on a “cash” basis like an individual does. But as you’ll soon see its economy isn’t growing properly right now, either, and hasn’t been for quite some time.

ZeroHedge recently published an article that summarized the larger point nicely:

…the U.S. economy increased some $334.5 billion in absolute nominal dollar terms.

But where did this growth come from? Why debt of course, and a lot of it. For the answer how much debt, we go to the U.S. Treasury's Debt to the penny website, where we find that debt on Sept 30, 2023 was $33,167,334,044,723.16 and debt on Dec 31, 2023 was $34,001,493,655,565.48.

In other words, it cost $834.2 billion in debt during Q3 to grow the U.S. economy by $334.5 billion

It boils down to this simple math:

- For every $2.50 in debt

- The economy (measured by GDP) grew by $1.00

- Net:

That isn’t what a sane person would consider a good trade… But folks, that’s Bidenomics in action!

Now, to be fair, this isn’t quite as nuts as it sounds – because deficit spending used to work better.

The problem is, the more deficit spending there is, the less effective it is at leading to economic growth.

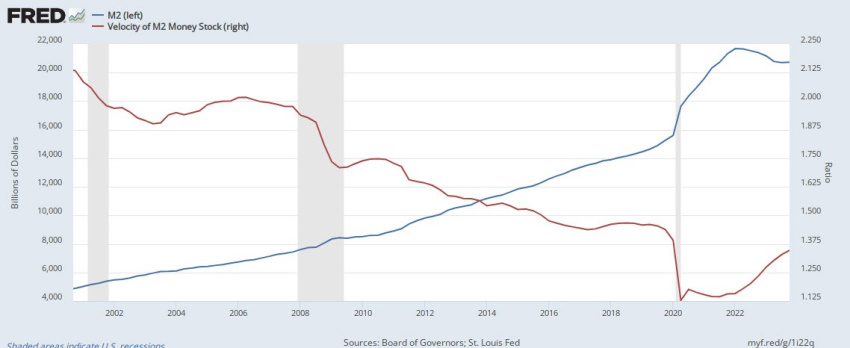

Look at this chart: the blue line represents total money supply; the red line represents “velocity” of money. “Velocity” is how economists measure economic activity – every time a dollar gets spent, velocity increases.

.jpg.aspx;)

Two decades ago, every $1 got spent about twice (you use it to buy a candy bar, and the shop owner uses it to pay his electric bill, for example) – creating $2 in economic activity.

Today, every $1 gets spent about 1.3 times – creating $1.30 in economic activity.

There’s a very clear lesson here: The more money there is, the less the amount of money really matters to the economy.

Factor in the sheer wastefulness and stupidity of many government spending projects (plus the $1 trillion in debt service payments!) and it’s easy to see why it costs the government $2.50 to produce ONE single dollar of real economic activity.

But the government is full of very slow learners… Who seem absolutely convinced that it’s possible, if they just keep spending, that somehow they’ll be able to reverse simple arithmetic.

If these are the people responsible for our nation’s economic future, doesn’t it seem like time to take matters into your own hands?

Keeping your finances sane when the government is crazy

Remember Einstein’s definition of insanity? Doing the same thing over and over again, hoping for a different result…?

By Einstein’s definition, Bidenomics is insane.

If you want to keep yourself out of the fiscal asylum, it’s time to take steps to keep your finances both safe and sane. Here’s how…

Ensure you own assets disconnected from the madness. Physical gold and silver aren’t promises to pay – they’re tangible physical assets you can hold in your hand. They can’t be hacked, canceled or inflated away. And during times when the rest of the world goes crazy, physical precious metals often soar in value.

Trust me: It’s comforting to know you own something real that no amount of economic or government insanity can destroy.

_______________

Phillip Patrick is Birch Gold Group’s primary spokesman and educator. He was born in London and earned a politics and international relations degree at the prestigious University of Redding in Berkshire, England. Growing up in London, he saw the risks of government overreach and socialist policies first-hand. He spent years as a private wealth manager at Citigroup on Lombard Street (the Wall Street of London). He joined Birch Gold Group as a Precious Metals Specialist in 2012.

© 2026 Newsmax Finance. All rights reserved.