Economists say that the labor market is being restrained by secular factors, those outside of regular macro potential.

These are opioid use, demographic changes toward an older population, and the downside effects of globalization as it alters the skills required by employers.

Between drug addicts, retiring baby boomers, and lazy Americans who won’t go back to school, there is now a labor shortage of, depending upon which media outlet is writing today’s popular anecdote, epic proportions.

This is not the only way to account for what we find in terms of payroll trouble. The far simpler explanation is that there just aren’t enough jobs. The Great “Recession”, a monetary-driven event, triggered the largest wave of mass layoffs in four generations but then even worse the recovery that followed it wasn’t really much of an expansion on its own terms.

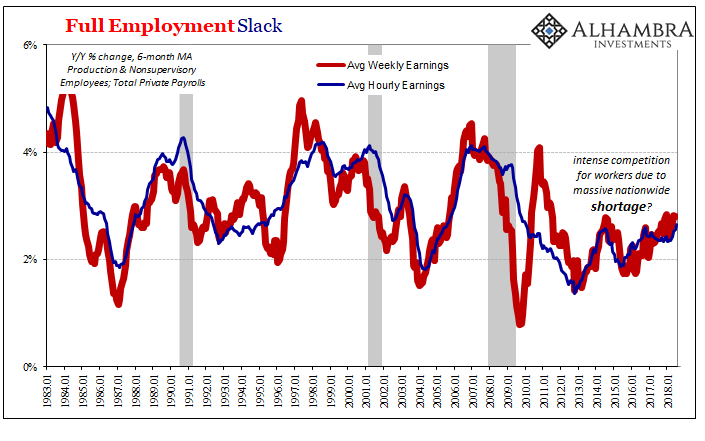

We know, obviously, into which camp the price of labor falls and it’s not the one with all the sexy anecdotes.

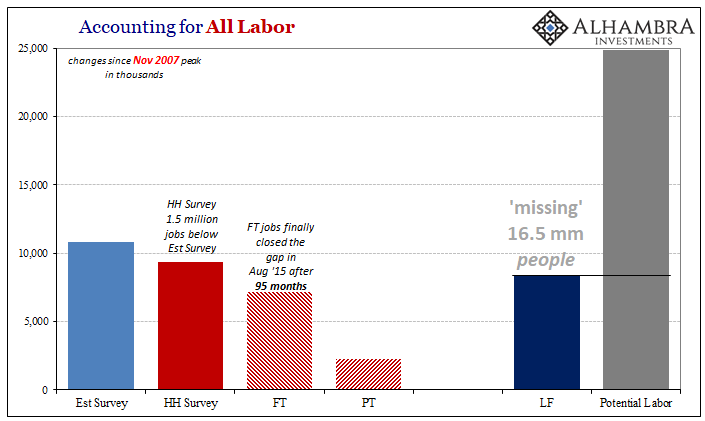

When I account for all the changes to the labor market I typically do so comparing peak-to-peak. That’s the only way to harmonize something like apples to apples, but in our current case it’s difficult to do that since November 2007 wasn’t just eleven years ago it was a world apart.

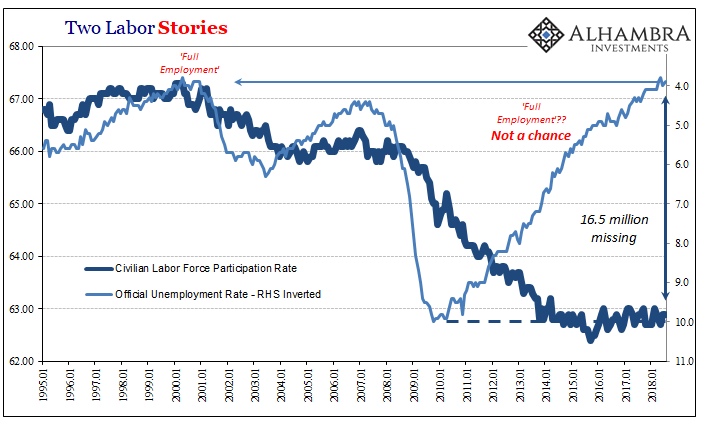

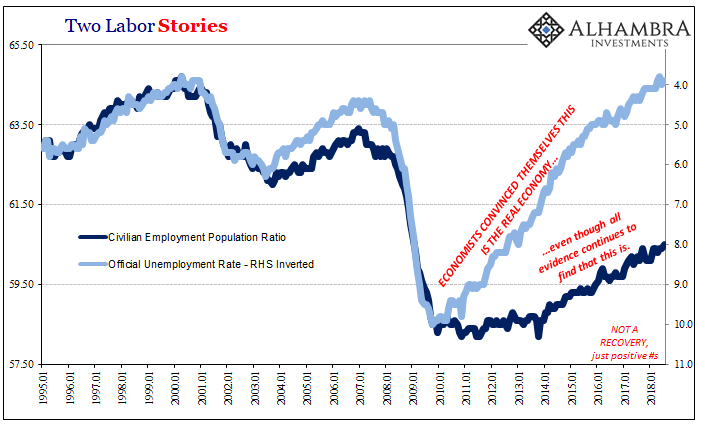

Since that month, there have been 24.9 million Americans added to the Civilian Non-institutional Population, the total pool of potential labor. The economy has added only 10.8 million jobs, payrolls in this view, according to the Establishment Survey. That’s been enough to bring the unemployment rate down to significantly less than it was in that long-ago month, 4.7% then compared to 3.9% in July 2018, but only because so many millions are left out of these figures.

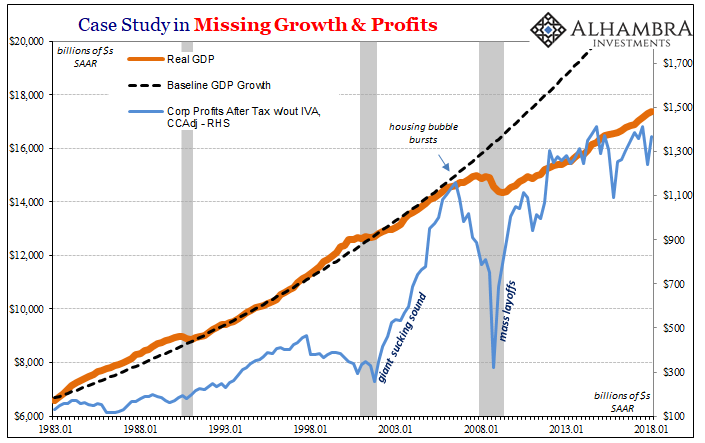

The real problem, however, is two problems. The first was 2008-09 and the collapse in economic function – the desperate action of liquidity starved corporations forced to shed payrolls as fast as logistically possible in order to preserve cash flow after having been stripped bare by the deeply malfunctioning banking system no longer providing any sort of liquidity backstop. That was bad.

The second is how afterward US companies were no longer interested, or able, to hire back what they lost. This was worse.

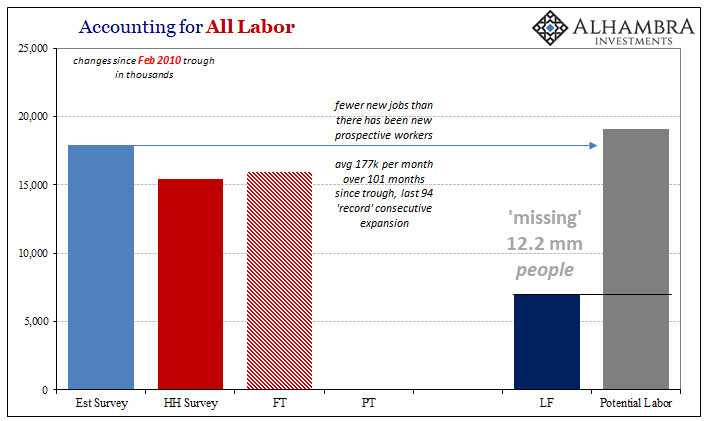

If we rerun our labor market account from February 2010, the trough, instead of November 2007, the prior peak, we find what may be a surprising result to many. The Civilian Non-institutional Population has increased by 19.1 million Americans over these now 101 months of “recovery” but the Establishment Survey only purports 17.9 million payroll gains despite a “record” 94 months of unbroken expansion.

By far, more Americans have gone “missing” from the labor numbers during the “recovery” than during the “recession.” In other words, there have been all along fewer jobs gained than people. In just the “recovery” portion, there hasn’t been enough growth to keep up with bare minimum population. It’s not as if we are undergoing a second baby boom, either, even population expansion is itself at a low. Low standards all around.

Now, not all of those in the potential labor pool would have joined the labor force, but we don’t know what the “correct” number would have been if the economy had actually entered a recovery. That simply means there haven’t been near enough new jobs to solve both issues; to bring back into meaningful employment all those who were laid off during the collapse, as well as absorb all new entrants who would truly wish to be employed.

Therefore, this labor problem is not something new, it goes back to both sections of the last “cycle.” Is it more likely, then, that fentanyl users, old age retirees, and recalcitrant former assembly line workers all got together around the time Lehman Brothers failed and decided to do those things to in order to pull themselves out of the jobs market? Or, the economy shrunk as it hit that same monetary brick wall that remains today unsolved?

It’s not just the last “recession”, which is one reason it is so hard to accept this rather disastrous fate. Especially now when the unemployment rate says it’s the best economy since the late 1990’s.

But even that is easily disproved by adjusting comparisons, calibrating terms so that we can compare apples to apples.

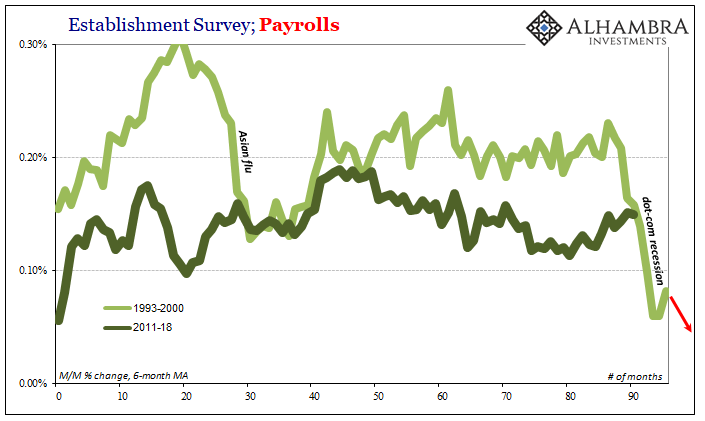

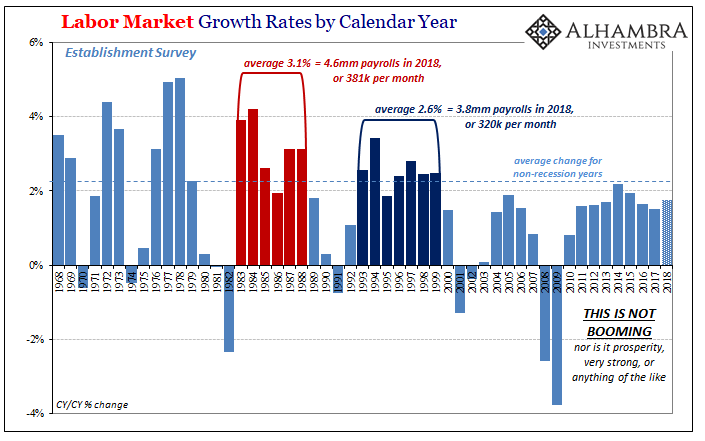

This month’s headline payroll gain of 157k is already below average by the low standards of the last 101 months (177k). In percentage terms, it is nothing at all like the dot-com era when GDP growth was 4% year after year, not just in one (or two) quarter(s) every four years.

The current labor market is expanding by just less than two-thirds the pace of the late 90’s economy. The only two times during that prior age when the labor market grew by as low a rate as we find today was during the downturn associated with the Asian flu (the first “rising dollar”) and in the months just prior to the dot-com recession.

That actually makes it sound better than this difference really is; when you take into account compounding this is a disastrous shortfall being strung out over so many years.

This is not a booming economy on any terms. It is only made so by ignoring what was lost ten years ago and then never came back. To avoid having to answer for why this all happened when it did, Economists have had to come up with really crazy stuff to justify the unjustifiable. And it truly is tragic, too, because there is a far, far greater chance the opioid epidemic is a result of this lack of jobs and economy rather than one of the causes of it.

It sure looks that way in every way. Why did deaths from heroin use, a recreational drug used for escape, skyrocket starting around 2010? That was, we are told, the start of record recovery. Instead, like the lack of wage acceleration, it’s another curious but deadly contradiction. Are former low skill workers taking to these because they don’t want to go back to school, or because they realize that there is no point if they did?

Jeff Snider is head of global investment research for Alhambra Investment Partners, a registered investment advisory based in Palmetto Bay, Florida.

© 2026 Newsmax Finance. All rights reserved.