Warner Bros Discovery has rejected Paramount Skydance's latest $30-a-share hostile takeover bid, but is giving the Hollywood studio seven days to see if it can come up with a better deal to buy the owner of HBO Max and the "Harry Potter" franchise, Warner Bros said Tuesday.

Paramount informally broached an even higher share price, $31 a share, Warner Bros said, apparently enticing the board to the table.

The rival bidder has until February 23 to submit its "best and final offer," which Netflix is allowed to match under the terms of the merger agreement, Warner Bros said.

Source: Reuters

Source: Reuters

"Our Board has not determined that your proposal is reasonably likely to result in a transaction that is superior to the Netflix merger," Warner Bros Chairman Samuel DiPiazza Jr. and CEO David Zaslav said in a letter sent on Tuesday to the Paramount board.

"We continue to recommend and remain fully committed to our transaction with Netflix."

The two media giants have been vying for control of Warner Bros, its flagship film and TV studios and deep content library, in a contest that highlights the high stakes of a rapidly shifting entertainment landscape.

Special: Thousands Already Paying Zero Taxes this Year. You Can Too... Read More Here

An unidentified Paramount financial advisor said their offer would be raised to $31 a share if Warner Bros agreed to open negotiations, and they could go even higher, Warner Bros said in the letter, adding it now expects a best and final proposal to include a price above that amount.

"Time is running out for Paramount with this saga wrangling on, for way too long, which is in no one's interest," PP Foresight analyst Paolo Pescatore said. "For now the ball is in Paramount's court."

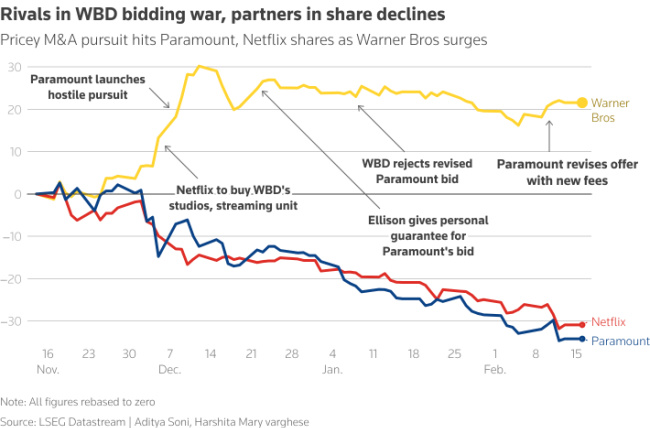

Paramount shares rose 1.7% in premarket trading, while Warner Bros was up 2.5%.

Paramount's current offer for the whole company comes to $108.4 billion, while Netflix is offering $82.7 billion just for its studio and streaming businesses.

Warner Bros, which has repeatedly rejected Paramount's offers to buy the entire company, is moving forward with a vote on Netflix's $27.75 a share bid for its studio and streaming services.

Shareholders will vote March 20 on the Netflix merger, which would take place after Warner Bros spins off its Discovery Global cable operations, which include CNN, TLC, Food Network and HGTV, into a separate, publicly traded company.

Discovery Global could fetch between $1.33 per share and $6.86 a share, according to Warner Bros estimates.

Warner Bros' decision to engage with Paramount, which required a special waiver from Netflix, marks a shift for the studio.

Paramount previously said the board "never meaningfully engaged" with them on six different offers executives made in the 12 weeks before Warner Bros announced the merger agreement with Netflix on December 5. A public hostile bid Paramount launched days later was rejected later that month.

Paramount's revised offer, which included a personal guarantee on $40 billion in equity from Oracle founder Larry Ellison, father to Paramount CEO David Ellison, was turned down in early January.

The move to open talks with a rival bidder also comes as Warner Bros faces mounting pressure from activist investor Ancora Holdings, which has built a stake in the company and plans to oppose the Netflix transaction.

Paramount is also pressing to add directors to Warner Bros board, eyeing Pentwater Capital Management CEO Matt Halbower as a potential nominee, Halbower said last week. Pentwater, which owns about 50 million shares of Warner Bros, has backed Paramount's bid.

“Every substantive complaint that the Warner Bros board had with Paramount’s previous offer has been addressed," Halbower said in an interview last week.

Urgent: Trump’s Trusted Insider ‘Prepare for the U.S Dollar Fallout’... See Here

To start talks with Paramount, Warner Bros’ board secured a special waiver from Netflix. Under its merger agreement, Warner Bros can engage with a rival bidder only if the board believes the offer could be superior, triggering a legal loophole that allows limited negotiations despite restrictions on talks.

Netflix issued a statement saying the deal has reached a milestone, with Warner Bros shareholders set to vote next month on the merger.

"While we are confident that our transaction provides superior value and certainty, we recognize the ongoing distraction for WBD stockholders and the broader entertainment industry caused by PSKY’s antics," Netflix said.

Last week, Paramount made a new attempt to win over Warner Bros shareholders by enhancing its previous bid without raising its overall offer of $30 per share.

Instead, Paramount has offered WBD's shareholders extra cash for each quarter the deal fails to close after this year and agreed to cover the $2.8 billion breakup fee the HBO owner would owe Netflix if it walked away.

Warner Bros said the amended merger agreement with Paramount still falls short of what its board would consider a superior proposal.

The Paramount offer still leaves key issues unresolved, including who would cover a potential $1.5 billion junior lien financing fee, what happens if debt financing falls through, and whether equity funding, backed by lead sponsor Larry Ellison, is fully certain, the Warner board wrote.

The letter noted that while Paramount has argued financing concerns are “not serious” given the “personal wealth of your lead equity sponsor and the credibility of your lending banks,” the draft agreements now require that, if debt financing becomes unavailable, additional equity must be funded to ensure the transaction can still close.

Ancora, which has a stake worth nearly $200 million, said last week that Warner Bros' board did not adequately engage in talks with Paramount Skydance over a rival offer for the whole company, including cable assets such as CNN and TNT.

© 2026 Thomson/Reuters. All rights reserved.