Global equity funds attracted the largest weekly inflow in seven weeks in the week through May 14, buoyed by a U.S.-China trade war truce that has significantly reduced the risk of a global recession.

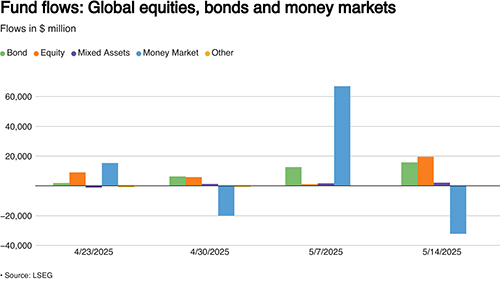

According to LSEG Lipper data, global equity funds bagged a net $19.57 billion in inflows during the week, the largest amount for a week since March 26.

U.S. President Donald Trump’s ongoing trade negotiations, including a 90-day tariff truce with China, signaled a pause in what analysts had warned could escalate into a devastating trade war capable of plunging the global economy into recession.

Softer-than-expected U.S. consumer inflation in April also offered relief to investors concerned about the inflationary impact of U.S. tariff policies, which had sharply lowered expectations for Federal Reserve rate cuts.

Urgent: Now Is the Time to Get in on These AI Stocks, Don't Wait... Free Stock Pick Report HERE

Investors bought a net $12.86 billion worth of U.S. equity funds, ending a four-week selling trend. The European and Asian equity funds also saw a net $3.29 billion and $2.89 billion worth of purchases, respectively.

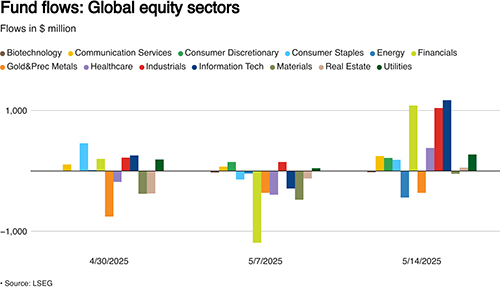

Global equity sectoral funds witnessed a net $3.77 billion worth of inflows, which halted a five-week-long selling streak. Investors purchased tech, industrial and financial sector funds, each of over $1 billion in value.

Global bond funds attracted a net $15.81 billion in the week through May 14, marking the strongest weekly inflow since March 5. Within the segment, high-yield bond funds saw $3.56 billion in net inflows—their largest in seven months—while government bond funds and loan participation funds recorded notable net purchases of $2.28 billion and $1.15 billion, respectively.

In contrast, global money market funds posted $32.22 billion in net outflows, partially reversing the prior week’s $66.97 billion in inflows.

Meanwhile, gold and precious metals commodity funds registered a third consecutive week of outflows, totaling $198 million, after 11 straight weeks of inflows.

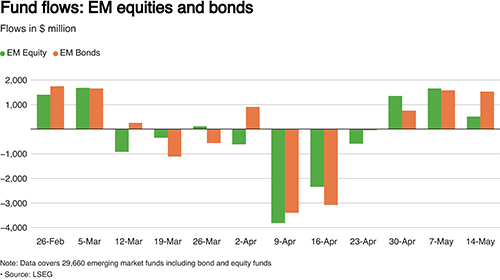

Data from 29,660 emerging market funds showed bond funds attracted about $1.52 billion, while equity funds drew $508 million—marking the third straight week of net inflows for both segments.

© 2026 Thomson/Reuters. All rights reserved.